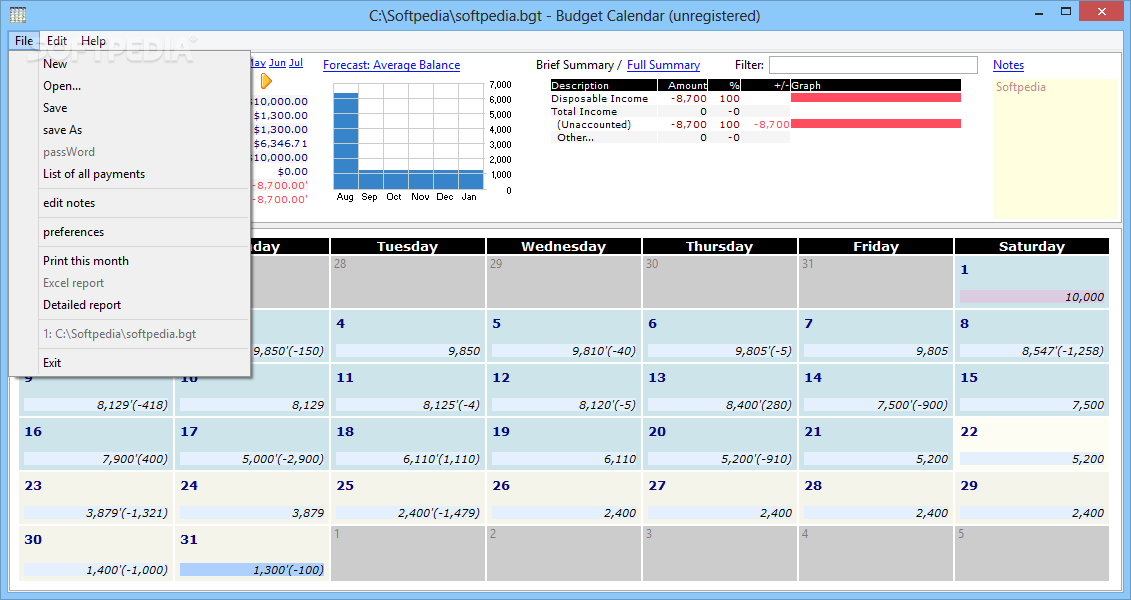

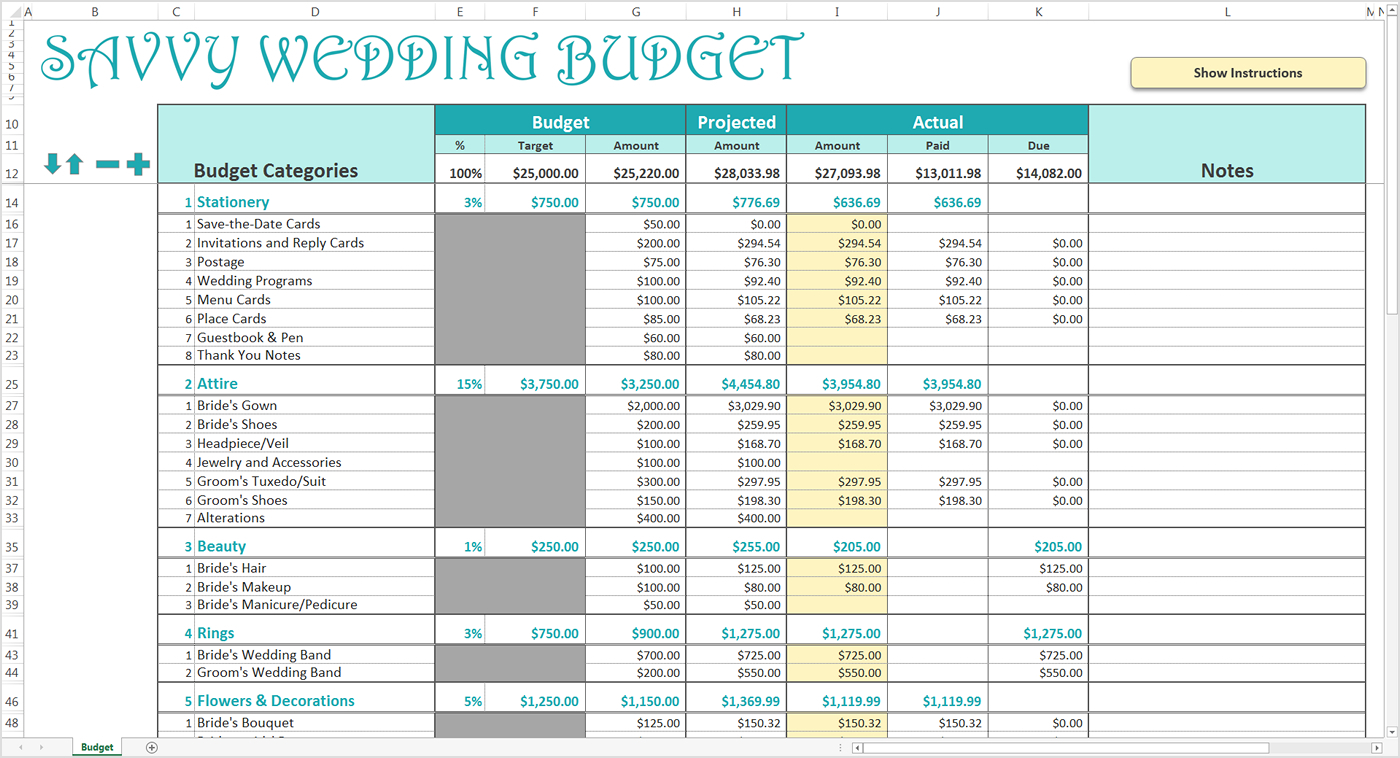

To complement that feature, you can put exception dates and days for particular transaction. You type them once, and excel formula will help you distribute it to whole months automatically. With recurring dates and days features, you don’t have to type your recurring income and expenses each week or month. Also, if your company has weekly positive balance policy, you can organize all of your payment easily. You can set your threshold values to see your company’s financial situations daily. This spreadsheet has monthly and weekly cash flow summary in calendar style. You can negotiate payment with your suppliers as well. With exact dates and days, you can push your customers to pay it on time or set earlier due dates. You can put exact invoice and purchase order payment dates as well as other regular expenses like salaries, office rentals, etc. You can break your income and expenses down into dates and days.

This company cash flow planner spreadsheet will solve your payment timing issue. You may see its balance is positive but in reality you have to spend your money before getting paid at each end of particular month. Cash flow budget spreadsheet usually doesn’t have details on exact income and expenses dates. This spreadsheet should complement your cash flow budget spreadsheet. About Business cashflow planner calendar template in Excelīusiness Cash Flow Planner spreadsheet fits small business companies who manage their tight cash flow where their expenses depends upon their income. This is useful for businesses to manage their cash position and working capital. This template comes with collection of monthly and weekly planners and calendars.

#Excel budget calendar download

Download cashflow planner calendar templates in Microsoft Excel and Spreadsheet.

0 kommentar(er)

0 kommentar(er)